The Bank has been warning staff that there will be little or no payments made through the Group Performance Share for 2020. In a message to staff earlier in the year, the bank said: “As you will have seen in the news, the impact of the coronavirus outbreak is expected to be significant on the UK economy throughout 2020. We don’t expect the financial performance of the Group during the year to be immune to this which will impact any potential Group Performance Share awards for 2020”. Yesterday, the bank announced the latest tranche of share awards to members of the Group Executive Committee (GEC).

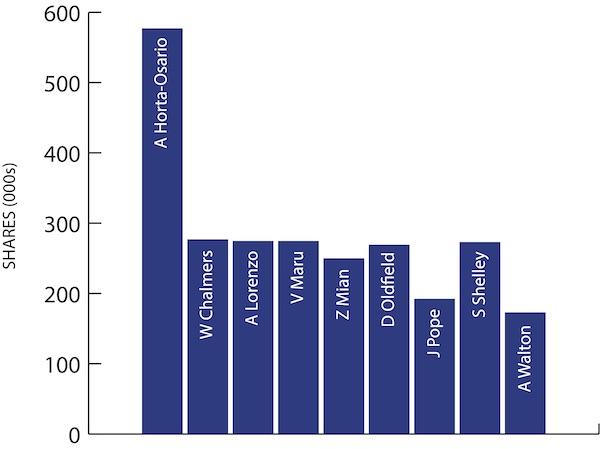

The latest awards are as follows:

And you know that there is not going to be much in the Group Performance kitty when the GEC voluntarily agrees to waive their awards for 2020. Since the bank’s message on share awards was published, members of the GEC have been given two lots of free share awards. Those free shares could be very lucrative, even if the Lloyds share price just reaches its less than dizzy pre-Covid heights.

So staff get nothing because of Covid, apart from a measly one-off bonus, but members of the GEC get free shares, which could quite quickly double in value. And, those awards are given to members of the GEC for just turning up for work. The payments are not performance related and even if the bank makes a massive loss for 2020 – which seems highly likely – they will still get their awards in 2021. That doesn’t seem remotely fair.

Pay 2021

With little or no Group Performance Awards, the 2021 pay award is going to be more important than ever before. In the past – when inflation was higher than the pay pot – the bank said that inflation was not a factor it took into account when deciding pay. It would be wrong and hypocritical of the bank to use inflation as an excuse to reduce the size of the pay pot and pay increases for staff. We would expect the bank to use next year’s pay round as an opportunity to drive staff pay closer to the rate for their job. Anything else would be totally unacceptable. We hope the bank supported staff unions don’t cave in and accept the first offer, like they have done in the past. We will keep members informed of developments.

The Next Wave

The reproduction number – R – is now above one and the virus is spreading exponentially according the Government’s medical advisers. We hope that the latest measures, which the Prime Minster announced yesterday, will help suppress the virus. The bank has quite rightly abandoned any attempt to get staff to return to the office and has paused the office-based experiments.

The bank says: “We’ll continue to do everything we can to keep you safe, and your support in playing your part and following our guidance is also greatly appreciated.”. That’s good to hear but the bank needs to look after its customers and customer-facing staff.

Branches have been getting back to some level of normality over the last few weeks and welcoming customers back into branches. The Government had told us that the main way to stop the spread of the virus is to reduce our contacts to an absolute minimum, and preferably only those in our own households or support bubbles. Proactively contacting customers in order to get them to visit branches should be stopped immediately. It’s putting customers and staff at unnecessary risk. The bank planned to announce on Monday that MAPAs and BCs were doing face-to-face interviews again but it quickly abandoned that idea. That was the right decision.

The Government’s latest guidance on what we can and can’t do is coming is changing quickly. We will review what’s being said and revert back to members in future Newsletters. In the meantime, members with any questions should contact the Union’s Advice Team on 01234 262868 (choose Option 1).